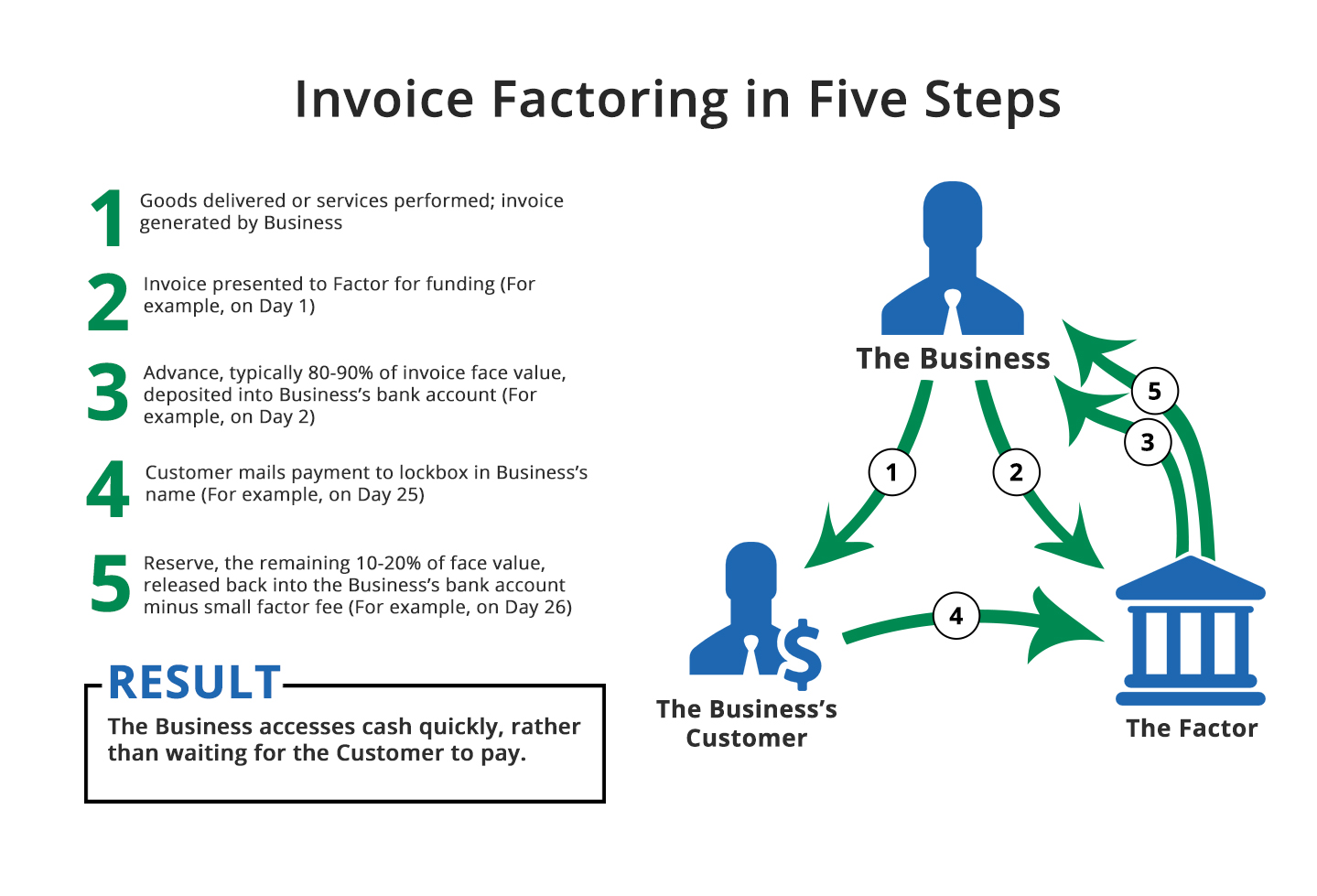

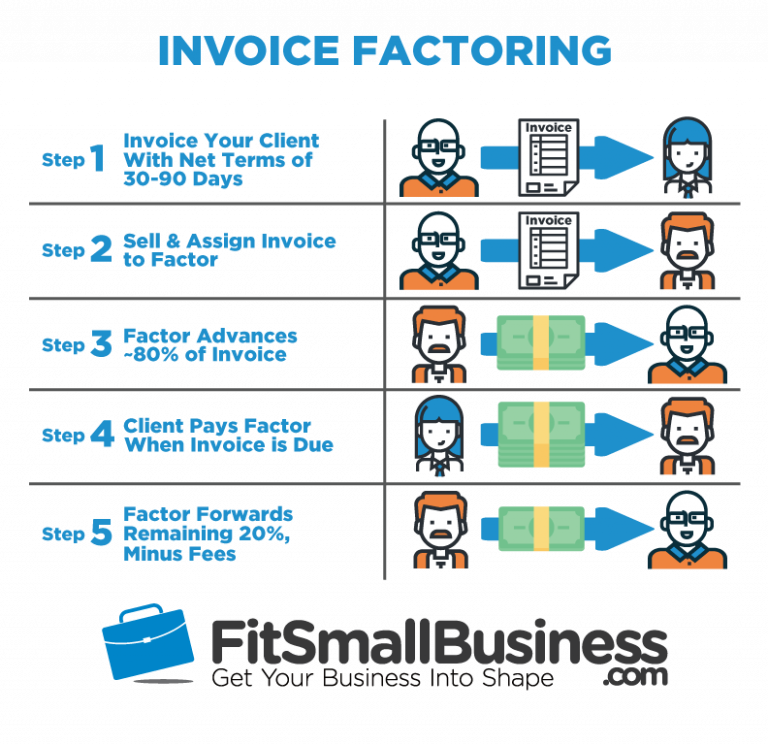

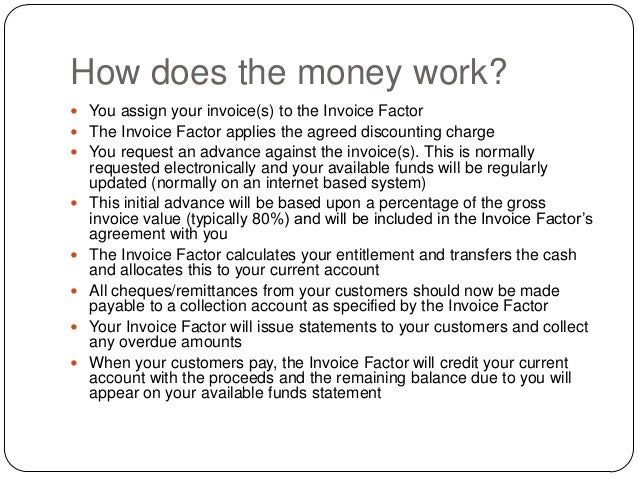

The company sells to businesses, not directly to consumers.The company is incorporated in the U.S.These are some common qualifications imposed by factoring companies: And, because the factoring company assumes the risk of nonpayment, factoring companies are also concerned with the creditworthiness of the business’ customers. Invoice factoring is easier to qualify for than traditional forms of financing, but businesses must still meet certain requirements. Consider these factors when choosing an invoice factoring company: Funding Qualifications What’s more, some factoring companies offer non-recourse agreements, whereas others offer exclusively recourse factoring. Invoice factoring companies feature different eligibility requirements, advance rates and factor fees than their competitors. This makes factoring faster than most traditional forms of financing. Each factoring company has its own application process, so talk to a representative to learn more about the relevant application form, approval process and average turnaround time.Ī major advantage of invoice factoring is that funds can be secured within a matter of days once an invoice is approved by the factoring company. Finally, complete the factoring company’s application form. You may also be asked to provide accounts receivable and accounts payable aging reports to demonstrate how promptly customers typically make payments.Ĥ. Because of the risk involved in invoice factoring, factoring companies typically require businesses to submit extensive personal and business tax returns and business financial records-usually going back at least three years. Also evaluate the availability of non-recourse versus recourse factoring agreements, and read online reviews to gauge each company’s reputation.ģ. Before entering an invoice factoring agreement, research factoring companies based on qualification requirements, as well as advance rates, factor fees and whether rates are variable or fixed. If your business is in a risky industry or is otherwise unable to obtain traditional financing, invoice factoring may be a good fit.Ģ. So, before you resort to invoice factoring, review available financing options like small business loans and lines of credit. Many factoring companies require that businesses have limited or no access to traditional financing options to qualify for invoice factoring. In general, businesses should follow these steps to work with an invoice factoring company:ġ. Under a non-recourse agreement, the factoring company bears all of the risks of nonpayment.Įach invoice factoring company imposes its own eligibility requirements and application procedures. If a business enters into a recourse factoring agreement and a customer does not pay their invoice, the business must buy that invoice from the factoring company at the end of the payment term. Invoice factoring agreements may also be recourse or non-recourse. Factor fees generally range from 0.50% to 5% per month an invoice remains outstanding and may be fixed or variable. Once the outstanding invoice balances are collected, the factoring company pays the business the remaining balance minus the factoring fees.

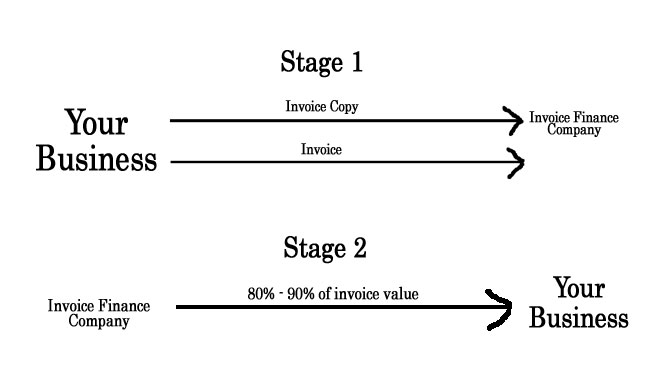

Under this approach, the factoring company becomes responsible for collecting outstanding invoice balances, not the business itself. Factoring companies typically buy invoices for between 70% and 95% of the total invoice value-known as the advance rate. Invoice factoring involves a business selling its outstanding invoices to a third-party factoring company in exchange for a portion of the balance upfront.

This means that invoice factoring is best for new businesses that don’t yet have a strong credit profile, while invoice financing is suitable for established businesses with good credit. With invoice factoring, the creditworthiness of the customers is most important on the other hand, invoice financing lenders look at the borrowing business’ credit. The business remains responsible for collecting the invoice balance, and once an invoice is paid, the business repays the loan. Instead, a business that uses invoice financing borrows money that is secured by the value of one or more outstanding invoices. In contrast to invoice factoring, invoice financing does not involve selling invoices to a third-party factoring company that becomes responsible for collections. The invoice factoring company-not the original business-is then responsible for collecting payment from customers. Invoice factoring is a type of financing that allows businesses to sell their outstanding invoices to a factoring company in exchange for a portion of the invoice amounts upfront.

0 kommentar(er)

0 kommentar(er)