The acquired portfolio is going to cost "roughly 30 basis points" of capital, CFO Richard Blackley said. In July, the retail giant selected Capital One as its new store credit card issuer after ending its co-branded card deal with Synchrony Financial. will acquire Walmart Inc.'s existing credit card receivables portfolio.Ĭapital One expects the portfolio, which will include both current and delinquent accounts, to consist of about $9 billion of receivables, President, Chairman and CEO Richard Fairbank said on a call to discuss fourth-quarter 2018 earnings.

#Capital one walmart credit card for free

Bank of America® Customized Cash Rewards credit card holders receive monthly FICO credit score access for free and zero fraud liability coverage.Capital One Financial Corp.

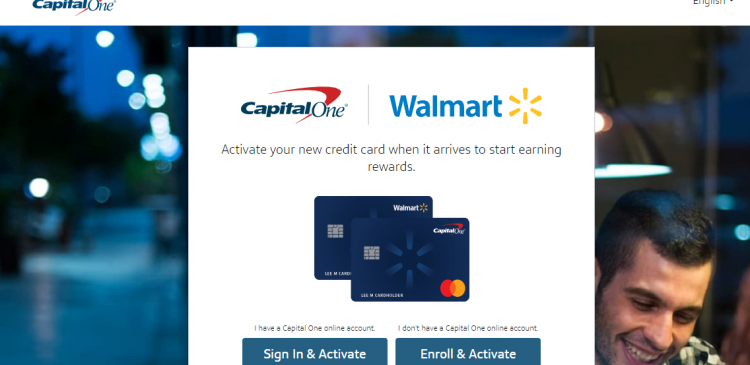

Benefits: The Capital One® Walmart Rewards™ Mastercard® users receive card benefits such as extended warranty protection, travel accident insurance, travel assistance services and concierge service. The Bank of America® Customized Cash Rewards credit card offers a $200 cash bonus when you spend online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening. Sign-up bonus: The Capital One® Walmart Rewards™ Mastercard® doesn't offer a sign-up bonus. Cardholders receive their 3% and 2% earnings on up to $2,500 in purchases each quarter, then 1% thereafter. The Bank of America® Customized Cash Rewards credit card earns 3% cash back in a category of your choice, such as gas, online shopping, travel, dining, drugstores, and home improvement or furnishings 2% back at grocery stores and wholesale clubs and 1% back on all other purchases. Rewards: The Capital One® Walmart Rewards™ Mastercard® earns 5% cash back at 5% cash back on store purchases for the first year with the store's mobile wallet, Walmart Pay, then 2% thereafter 2% back on dining and travel and 1% back on all other eligible purchases. Capital One® Walmart Rewards™ Mastercard®Īnnual fee: Neither card charges an annual fee. Various travel and purchase protection benefits are available to Amazon Rewards Visa Signature Card users, such as an auto rental collision damage waiver, baggage delay insurance, extended warranty protection, lost luggage reimbursement, travel accident insurance, and travel and emergency assistance.īank of America® Customized Cash Rewards credit card vs. Benefits: The Capital One® Walmart Rewards™ Mastercard® benefits include extended warranty protection, travel accident insurance, travel assistance services and concierge service. The gift card value will increase to $100 if you have an eligible Amazon Prime membership upon approval for the card.

The Amazon Rewards Visa Signature Card offers a $60 gift card upon approval. Sign-up bonus: The Capital One® Walmart Rewards™ Mastercard® doesn’t offer a sign-up bonus. When paired with an eligible Amazon Prime membership, your earnings at and Whole Foods Market will jump to 5%.

Amazon Rewards Visa Signature Card users earn 3% cash back at and Whole Foods Market, 2% back at drugstores, gas stations and restaurants, and 1% back on all other purchases. Rewards: The Capital One® Walmart Rewards™ Mastercard® earns 5% cash back at 5% cash back on store purchases for the first year with the store’s mobile wallet, Walmart Pay, then 2% thereafter 2% back on dining and travel and 1% back on all other eligible purchases.

0 kommentar(er)

0 kommentar(er)